Golden Growth for Your Financial Future

At AurumZone, we believe your savings should work as hard as you do. Our Premium Savings Account combines the security you need with the growth you deserve, wrapped in the luxury service that defines AurumZone.

Savings Account Perks

Maximize your savings with these exclusive benefits

Great rate with no minimum balance

Grow your savings with an interest rate of 0.30%† since September 10, 2024. Earn the same great rate on every dollar in your Account.

No unfair^ fees or service charges

We simply don't believe in unfair fees. So you won't have to pay to save with us.

Reach your goals faster

A Tangerine Savings Account comes with tools to make it super simple to reach your goals.

Automate your savings

With an Automatic Savings Program, you can save without even thinking about it.

† Interest rate is subject to change without notice. ^Some fees may apply for special services.

Earn a 4.50% Savings rate

No hoops – just an awesome rate on TFSA, RSP & regular Savings to help you reach your goals.

Savings Calculator

See when you can reach your savings goal with our Automatic Savings Program

Your Savings Timeline

*Estimator tool is for demonstration purposes only and should not be relied upon as financial or other advice. Calculations are estimates only based on the current interest rate of 0.30%, which may change, and based on interest calculated daily and paid monthly, assuming no withdrawals.

Reach Your Financial Goals

Smart tools to help you save for what matters most

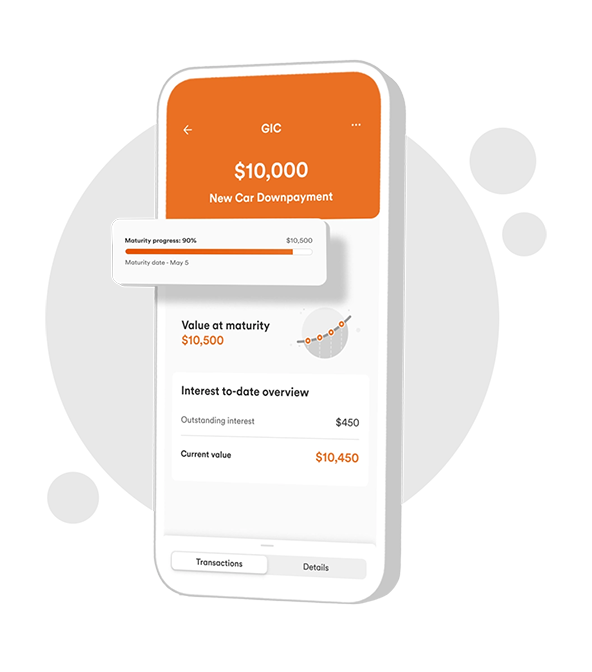

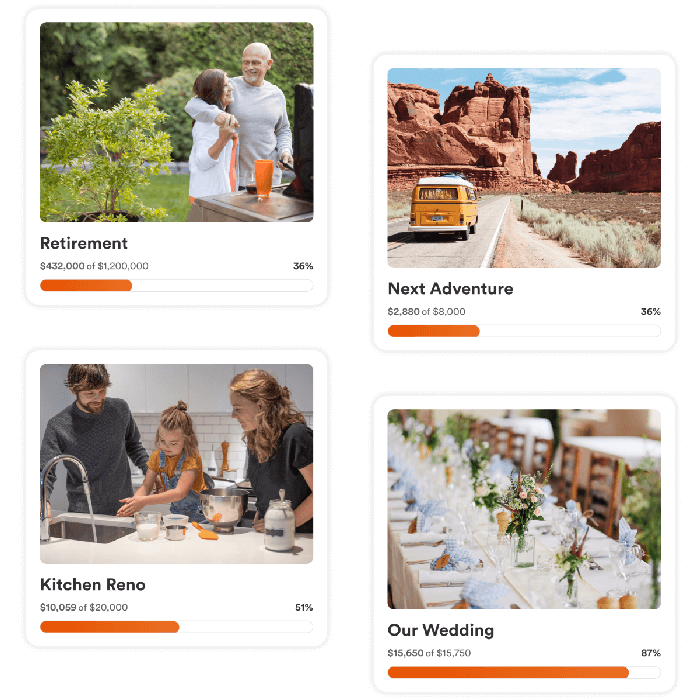

Goal Tracking

Visualize your progress with intuitive savings trackers and milestones.

Automatic Savings

Set it and forget it with recurring transfers tailored to your goals.

Smart Alerts

Get notified when you're on track or need to adjust your savings.

Your security matters

Keeping your banking info safe isn't the only thing required to protect your accounts. Discover expert tips on how to stay ahead of fraudsters.

Savings Account FAQs

Quick answers to your most common questions

To open a Savings Account online or in our app, you'll need to start by becoming a Client. We'll need your email address, your full name, your date of birth, and your Canadian address. You'll also need to enter your Social Insurance Number (SIN) if you're opening an interest-earning Account, such as a Savings Account.

Here are the main differences between a Tangerine Chequing Account and Savings Account:

Chequing Account

- Convenient for day-to-day transactions like shopping, paying bills, withdrawing cash and sending money to a friend

- Designed to make it easy to access your cash

Savings Account

- Competitive interest rate helps you save money faster

- Keeping your savings "out of sight" in a separate account from your daily activity can make it easier to avoid spending that money

- Can have multiple savings accounts to save for different goals

- Funds are accessible, making them a good option for things like emergency funds

Setting up an Automated Savings Program (ASP) is easy.

Set up online at Tangerine.ca:

- Log in and scroll down to 'Money Management Tools' and click 'Automatic Savings Program'.

- Click 'Start ASP' and follow the prompts

- And remember, you can always go in and make changes to your automatic transfer amount, skip scheduled transactions or cancel your ASP

Set up with the Mobile Banking app:

- In the app, hit 'More' on the bottom of your screen and then hit 'Automatic Transfers' and follow the prompts