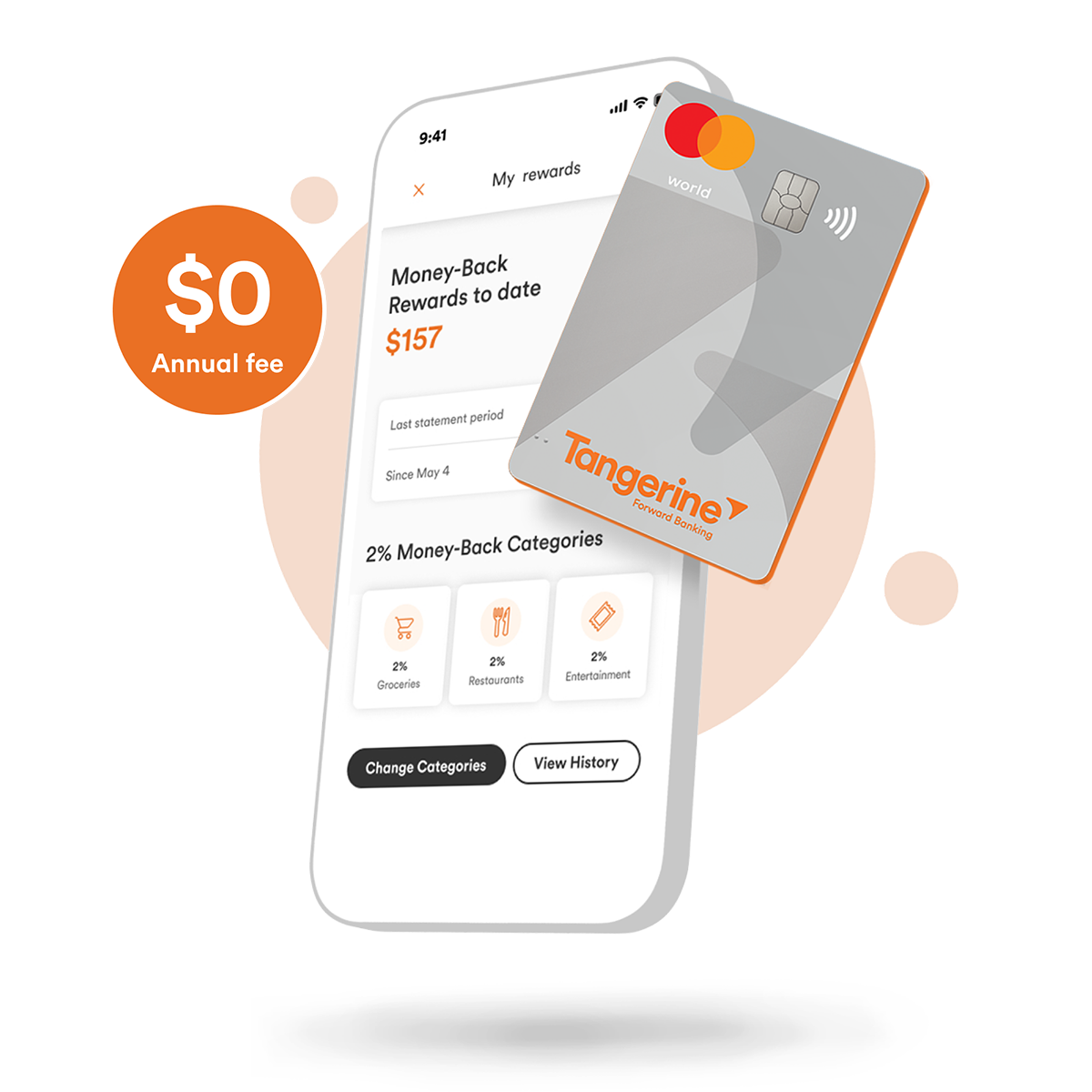

No annual fee

It’s another way to help you save while you’re spending.

Unlimited 2% cash back in 2 categories of your choice + 0.5% back on everything else

Easily customize categories to suit your needs and automatically receive your Money-Back Rewards every month.

Uncomplicated Card benefits⁵

A Tangerine Savings Account comes with tools to make it super simple to reach your goals.

Transfer and save

During your first 30 days, transfer balances up to your credit limit and pay an interest rate of only 1.95% on the transferred balance for 6 months (22.95% after that). A Balance Transfer fee of 1% on the amount transferred will apply.11

† Interest rate is subject to change without notice. ^Some fees may apply for special services.

Set your sights on the season

Change your cash back categories to suit your spending.

Get a bonus 10% cash back – up to $100¹⁰

Don’t leave this limited time offer on the table! Apply today for the Tangerine World Mastercard®.

2% Money-Back Categories

Get your Rewards deposited into your Tangerine Savings Account and earn more!

Pick two 2% Money-Back Rewards Categories

Choose your categories based on your spending to maximize your savings.

Unlock a third 2% category

...when you have your Rewards deposited automatically into a Tangerine Savings Account.

Choose from:

Elevate Your Experience

Premium benefits designed for your lifestyle

AurumZone Benefits

-

Purchase Assurance and Extended Warranty

You may receive a lifetime maximum of up to $60,000.

-

Mobile Device Insurance

Up to $1,000 of coverage for your mobile device.

-

Rental Car Collision/Loss Damage Insurance

Get damage & theft protection for car rentals.

-

Add up to 5 users on one Account

Add up to 5 people – one Account, multiple Cards, no annual fee for those Cards.

World Mastercard® Benefits

-

Mastercard® Travel Pass Provided By DragonPass

Exclusive dining, retail and spa offers in over 650 airports worldwide, along with access to over 1,300 airport lounges at $32 USD per visit.

-

Mastercard® Travel Rewards

While travelling outside Canada, use this Card to unlock cashback offers at participating merchants.

-

On-Demand and Subscription Services

Enjoy special benefits and offers from on-demand apps & subscription services.

Mobile Wallets

Add your Tangerine Client Card and Credit Card to your Apple Pay, Google Pay, and Samsung Pay mobile wallets and use it where contactless payments are accepted.

Fees & Interest

$0 annual fee with the Tangerine World Mastercard®

|

Fee Type

|

Amount/Rate

|

|---|---|

|

Annual Fee

|

$0

|

|

Interest Rate on Purchases

|

19.95%

|

|

Balance transfer fee

|

1% of the amount transferred (min $5.00)

|

|

Promotional Balance transfer interest rate

|

0.99% for first 6 months (19.95% after)

|

|

Foreign currency conversion

|

2.5% of transaction amount

|

|

Cash advance fee

|

$3.50 (within Canada), $5.00 (international)

|

|

Interest on Cash Advances

|

22.95%

|

|

Dishonoured payment

|

$25.00

|

|

Over-limit fee

|

$25.00

|

|

Statement copy

|

$5.00 per statement (current month free)

|

|

Card replacement

|

$15.00 (rush delivery)

|

Interest-Free Grace Period

You won't be charged interest on new purchases if you pay your balance in full by the payment due date each month. This grace period typically lasts between 21-25 days from your statement date.

Cash Advances & Balance Transfers

Interest begins accruing immediately on cash advances and balance transfers. There is no grace period for these transactions. The interest rate for cash advances is typically higher than for purchases.

Partial Payments

If you don't pay your balance in full, interest is charged from the original purchase date on the remaining balance and on all new purchases until they're paid in full.

Daily Interest Calculation

Interest is calculated daily by multiplying the balance by the daily periodic rate (annual rate ÷ 365 days). This amount is then added to your balance at the end of each billing cycle.

Your security matters

Keeping your banking info safe isn't the only thing required to protect your accounts. Discover expert tips on how to stay ahead of fraudsters.

Savings Account FAQs

Quick answers to your most common questions

To open a Savings Account online or in our app, you'll need to start by becoming a Client. We'll need your email address, your full name, your date of birth, and your Canadian address. You'll also need to enter your Social Insurance Number (SIN) if you're opening an interest-earning Account, such as a Savings Account.

Here are the main differences between a Tangerine Chequing Account and Savings Account:

Chequing Account

- Convenient for day-to-day transactions like shopping, paying bills, withdrawing cash and sending money to a friend

- Designed to make it easy to access your cash

Savings Account

- Competitive interest rate helps you save money faster

- Keeping your savings "out of sight" in a separate account from your daily activity can make it easier to avoid spending that money

- Can have multiple savings accounts to save for different goals

- Funds are accessible, making them a good option for things like emergency funds

Setting up an Automated Savings Program (ASP) is easy.

Set up online at Tangerine.ca:

- Log in and scroll down to 'Money Management Tools' and click 'Automatic Savings Program'.

- Click 'Start ASP' and follow the prompts

- And remember, you can always go in and make changes to your automatic transfer amount, skip scheduled transactions or cancel your ASP

Set up with the Mobile Banking app:

- In the app, hit 'More' on the bottom of your screen and then hit 'Automatic Transfers' and follow the prompts