Key features

Globally diversified

Emphasis on Canadian companies you know, and still well diversified internationally.

Established presence

Established track record of over 10 years so you can invest confidently.

Your life, your goals

Suited to meet the growth needs of your life stages.

We'll help you choose the right Portfolio

Overview

With 70% in bonds, this is the least risky Portfolio of the bunch. The other 30% is invested in stocks, which provide growth potential. It's designed to be a safer bet with more modest returns for the more risk-averse.

This Portfolio may be right for you if you're:

- A low–medium risk investor

- Seeking stability

- Looking for income and some potential for capital appreciation

Performance

| Term | Annualized returns as of March 31, 2025 net of fees |

|---|---|

| 1 year | 8.65% |

| 3 years | 4.20% |

| 5 years | 4.38% |

| 10 years | 3.35% |

| Inception | 4.15% |

Overview

Offers a balance between investments in stocks and bonds that increases your potential for growth while still maintaining stability.

This Portfolio may be right for you if you're:

- A low–medium risk investor

- Seeking a balance between capital appreciation and modest income potential

Performance

| Term | Annualized returns as of March 31, 2025 net of fees |

|---|---|

| 1 year | 10.70% |

| 3 years | 6.80% |

| 5 years | 8.84% |

| 10 years | 5.77% |

| Inception | 5.67% |

Overview

75% of this Portfolio's investments are in stocks, which provides potential for long-term growth. The remaining 25% in bonds serves to balance out some of the associated risk with a little stability.

This Portfolio may be right for you if you're:

- A medium risk investor

- Seeking a primarily capital growth potential and some income

Performance

| Term | Annualized returns as of March 31, 2025 net of fees |

|---|---|

| 1 year | 11.70% |

| 3 years | 8.09% |

| 5 years | 11.10% |

| 10 years | 6.99% |

| Inception | 6.43% |

Overview

Looking for a dividend paying Tangerine Portfolio? This is the one for you. By investing in the stocks of companies from around the world that are expected to pay dividends, this Portfolio seeks to provide you with annual dividend income along with growth potential.

This Portfolio may be right for you if you're:

- A medium risk investor

- Seeking capital growth potential and dividend income

Performance

| Term | Annualized returns as of March 31, 2025 net of fees |

|---|---|

| 1 year | 19.82% |

| 3 years | 11.39% |

| 5 years | 15.15% |

| 10 years | - |

| Inception | 9.28% |

Overview

With no bonds to balance it out during market downturn, this Fund can be the riskiest portfolio we offer. However, with that risk comes a potential for reward.

This Portfolio may be right for you if you're:

- A medium–high risk investor

- Seeking primarily capital growth potential

Performance

| Term | Annualized returns as of March 31, 2025 net of fees |

|---|---|

| 1 year | 13.54% |

| 3 years | 10.20% |

| 5 years | 14.76% |

| 10 years | 8.83% |

| Inception | 10.54% |

Allocation & Holdings

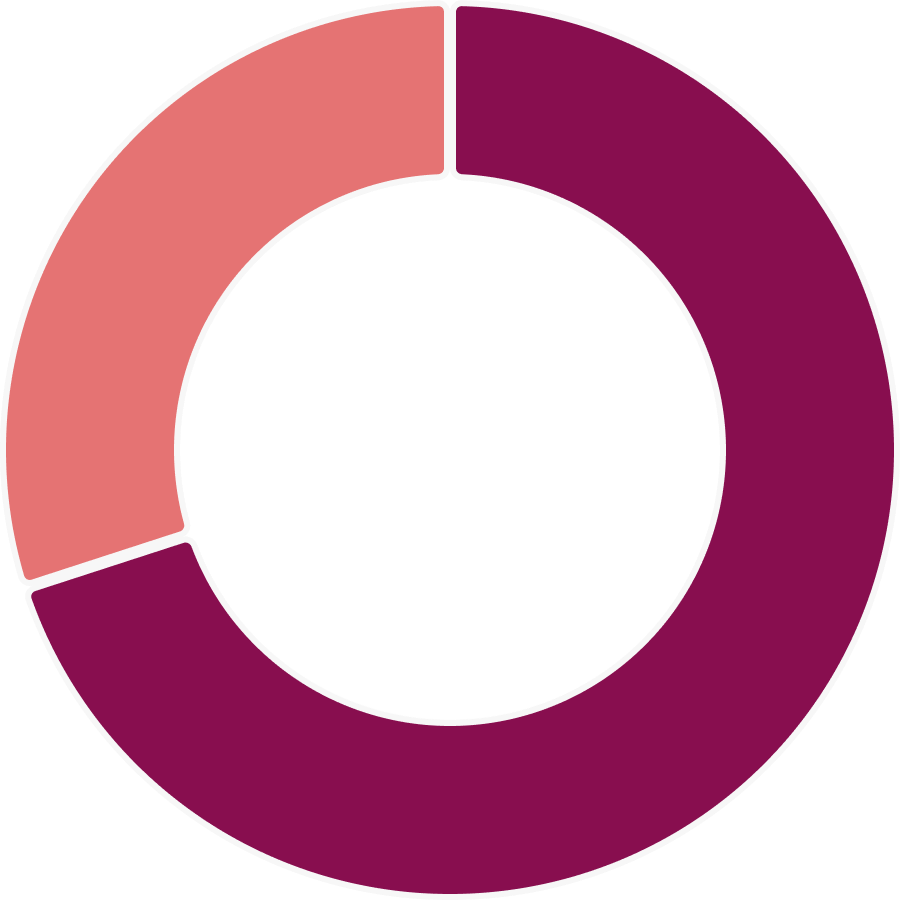

Stock Allocation Breakdown