Premium No-Fee Chequing

Everything you need for your daily banking with none of the fees you don't want

No Monthly Fees & No Minimum Balance

Keep your money working for you, not sitting idle just to avoid fees. Our no-fee promise means exactly that - no hidden charges or minimum balance requirements.

‡Standard account fees waived

Free Interac e-Transfer®

Send money instantly and securely to anyone in Canada. With Autodeposit, incoming transfers go straight to your account without any action needed.

®Interac e-Transfer is a registered trademark

Shop with Confidence

Our Interac & Visa* Debit comes with Zero Liability protection, ensuring you're never responsible for unauthorized transactions.

*Visa Int./Licensed User

Unlimited Transactions

Debit purchases, bill payments, pre-authorized transactions - do as many as you need without worrying about transaction limits or fees.

Some exceptions may apply

Move your pay. Get $250.1

What? Were you expecting something more complicated?

1Offer conditions apply. See details for eligibility requirements.

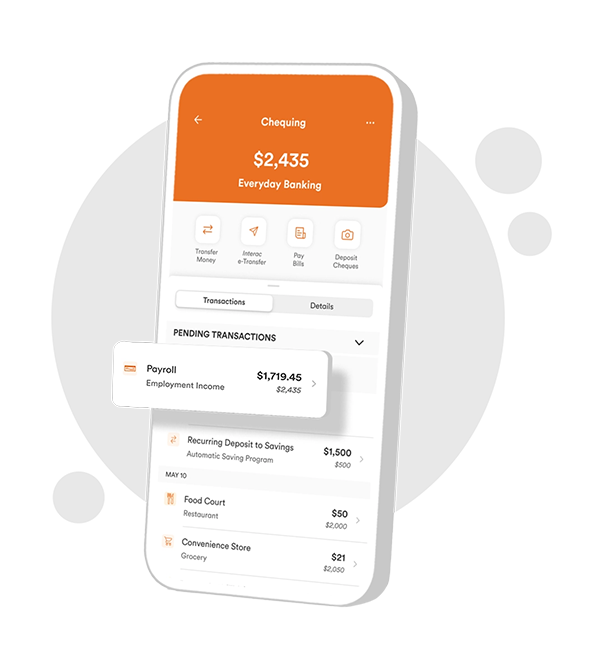

Direct deposit and pre-authorized payments

When you have your pay deposited into your Account and pre-authorized payments taken automatically from your Account, you enjoy instant access to your deposited money along with worry-free payments.

Get paid up to 2 days faster with direct deposit

Never miss a bill payment with automatic withdrawals

Eliminate the hassle of manual payments

Monthly Account fees? No thanks.

If you pay $13 per month with your current bank, then by switching to Tangerine today, in 30 years you'd save:*

*Estimator tool is for demonstration purposes only and should not be relied upon as financial or other advice. Calculations are estimates only based on the information you provide and assume no fees for non-standard transactions are incurred in the Tangerine Chequing Account. Actual savings may vary. All rates, fees, features, offers and benefits and related terms and conditions are subject to change.

Mobile Wallets

Add your Tangerine Client Card and Credit Card to your Apple Pay, Google Pay, and Samsung Pay mobile wallets and use it where contactless payments are accepted.

Where are the fees?

You won't pay any fees for your daily chequing transactions. For other transactions, a fee may apply. View the complete list of Account fees.

| Transaction Type | Fee |

|---|---|

| Online daily banking | Free |

| Interac e-Transfer® | Free |

| First cheque book with 50 cheques | Free |

| Additional cheque books | $50 each |

| 1 free stop payment | per year, $12.50 each thereafter |

| Replacement Card | Free |

| Canadian drafts | $10 |

| Non-Sufficient Funds | $45 |

| ABM deposits / withdrawals | Free |

| Other ABM withdrawals in Canada | $1.50 |

| Other ABM withdrawals worldwide | $3 |

| Foreign Currency Conversion Fee | 2.50% |

Fees are subject to change. Please see our full schedule for complete details.