Great rate with no minimum balance

Grow your retirement savings with an interest rate of 0.30%† since September 10, 2024.

Flexibility

Easily move your money to other investment choices within your RSPRSP at any time. You’re never locked in.

No unfair^ fees while you are with us

We simply don’t believe in unfair fees. Why should you have to pay money to save for retirement?

Benefits of an RSP

You pay less tax

Contributions to an RSP can be deducted from your taxable income, which is especially worthwhile if you use this tax saved to make a contribution for next year or to pay off debts.

Your RSP contribution is tax sheltered

The money you contribute, up to your contribution limit, and the earnings you make on your investments are only subject to tax when you withdraw from your RSP.

You can split your income with a Spousal RSP

Spousal RSP contributions help ensure future retirement income is split evenly between you and your partner.

Earn a 4.50% Savings rate

No hoops – just an awesome rate on TFSA, RSP & regular Savings to help you reach your goals.

RSP Savings Calculator

See when you can reach your retirement savings goal with our RSP Savings Account

Your RSP Growth

*Estimator tool is for demonstration purposes only and should not be relied upon as financial or other advice. Calculations are estimates only based on the current interest rate of 0.30%, which may change, and based on interest calculated daily and paid monthly, assuming no withdrawals. Tax refund estimate assumes contributions are tax deductible at your marginal rate.

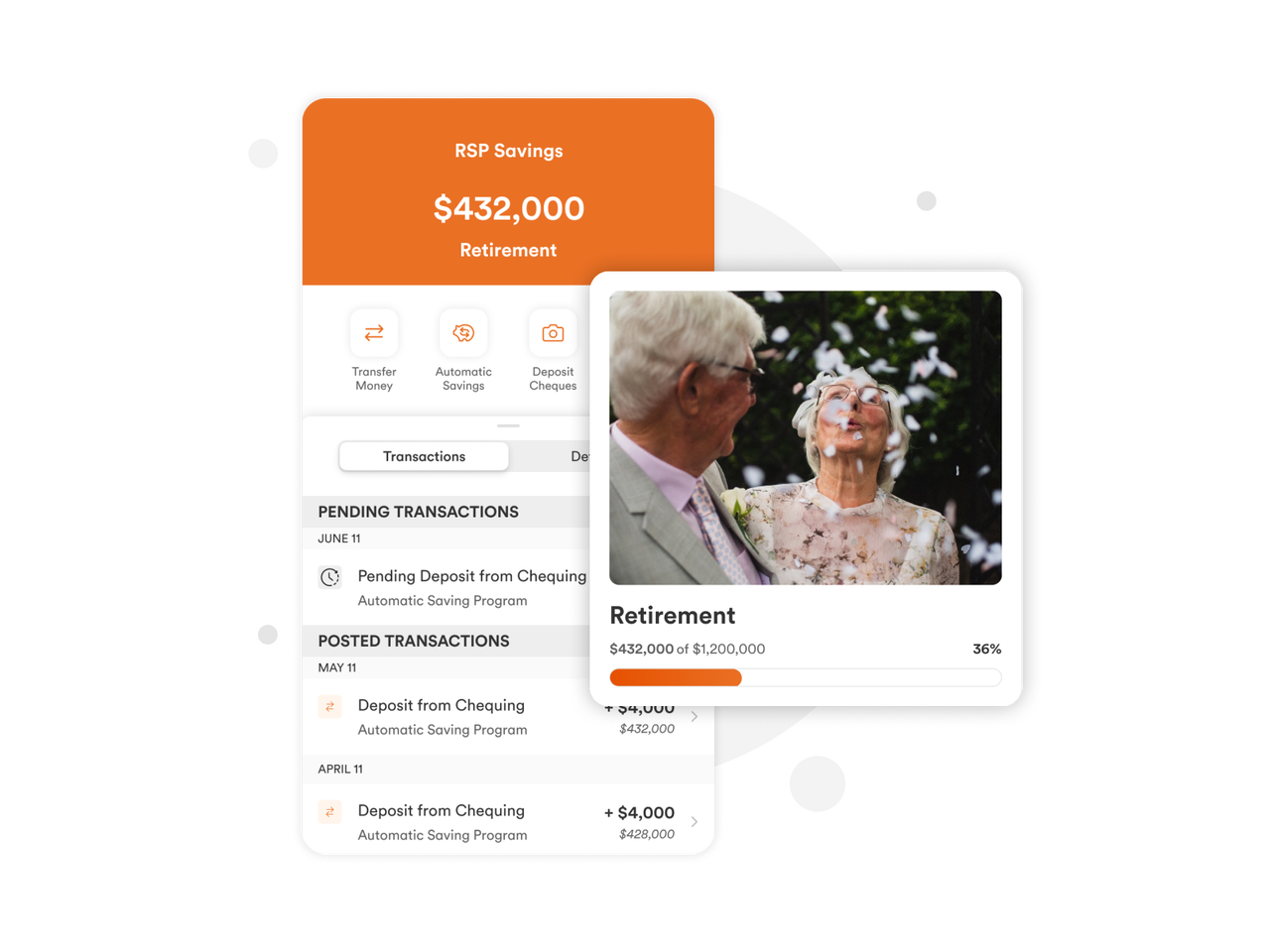

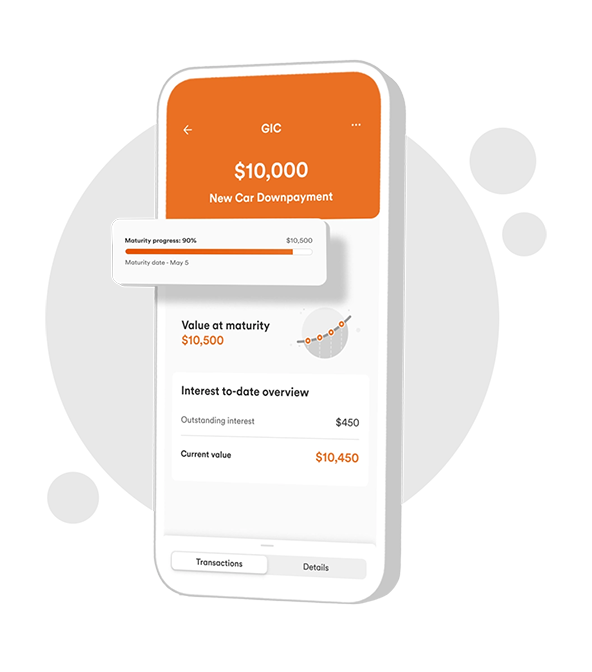

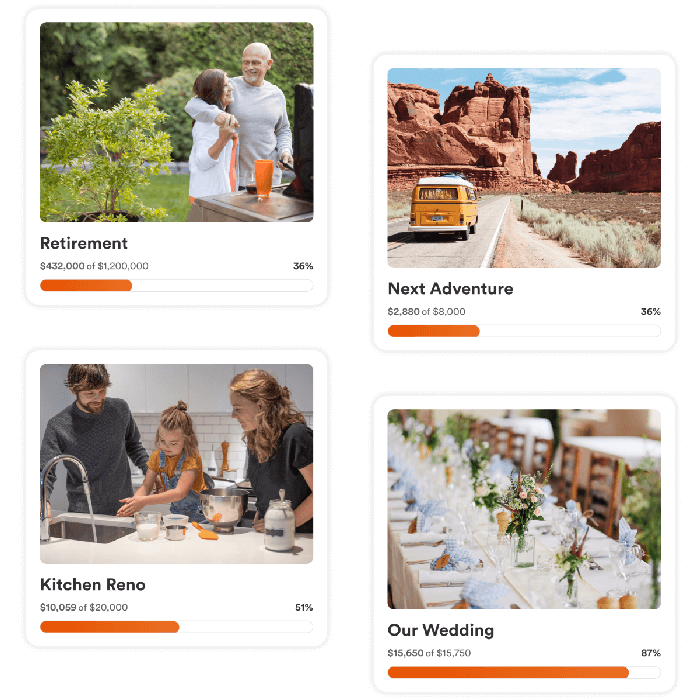

Reach Your Financial Goals

Smart tools to help you save for what matters most

Goal Tracking

Visualize your progress with intuitive savings trackers and milestones.

Automatic Savings

Set it and forget it with recurring transfers tailored to your goals.

Smart Alerts

Get notified when you're on track or need to adjust your savings.

Your security matters

Keeping your banking info safe isn't the only thing required to protect your accounts. Discover expert tips on how to stay ahead of fraudsters.